Are you looking for a 401(k) savings guide? This post will go through how much I think you should have in your 401(k) by age in order to have a comfortable retirement in your 60s and beyond. My goal is for all of you to become 401(k) millionaires before your retire.

I’ve been retired since 2012 after working 13 years in investment banking and maxing out my 401(k) each year since 1999. Since 2012, my 401(k), which is now a rolled over IRA, is worth over $1.35 million today. And that is with zero contribution from 2012 until now.

In addition, I’ve been maxing out my Solo 401(k) each year since 2012. A Solo 401(k) is for small business owners, where you can contribute both the employee maximum and employer maximum, if your business generates enough profits.

Diversify into real estate: In addition to maxing out your 401(k) for a wealthier retirement, diversify into real estate as well. Fundrise manages over $3 billion in private real estate investments, mainly in the Sunbelt region where valuations are lower and yields tend to be higher. With the Fed embarking on a multi-year interest rate cut cycle, there should be increased demand in real estate in the coming years. I’ve personally invested over $400,000 with Fundrise so far.

401(k) As A Retirement Savings Account IS Not Enough

Unfortunately, the 401(k) is one of the most woefully light retirement instruments ever invented. The 2025 401(k) contribution limit goes up by only $500 to $23,500.

A 401(k) is part of your new three-legged retirement stool. The other two legs include your after-tax investment accounts and your side hustles. In other words, it’s up to all of us to take care of our own retirement needs and not depend on anything else.

Although the 401(k) pales in comparison to a nicely funded pension, even more disappointing than the 401(k) is the IRA. With the IRA retirement plan, you can only contribute $7,000 in pre-tax dollars for 2024. Further, you can only contribute pre-tax dollars if you make under $87,000 a year as an individual and $143,000 as a married couple. You can only contribute the maximum $7,000 if you make less than $77,000 as an individual and $123,000 as a married couple. What about the rest of us?

Meanwhile, you have to make less than $161,000 a year as a single person or $240,000 as a married couple for the privilege of contributing after- tax dollars to a Roth IRA. You can only contribute the maximum $7,000 in 2024 if you earn less than $146,000 as an individual or $230,000 as a married couple.

Give me a pension that pays 70% of my last year’s salary for the rest of my life over a 401k or IRA any time! At least with the 401(k), anybody can contribute.

Free Financial Checkup: If you have over $100,000 in investable assets, you can receive a free financial analysis from an Empower advisor by signing up here. An annual review is always worthwhile as your asset allocation can shift significantly over time, and your financial situation may evolve as well. We all have financial blindspots that are worth recognizing to build more future wealth.

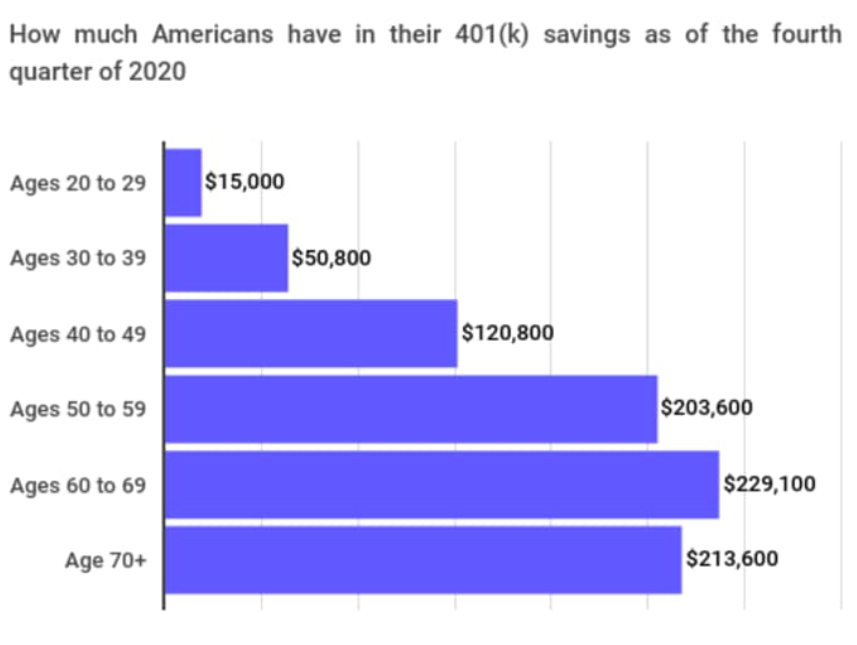

Average 401(k) Retirement Balances

Based on Fidelity’s 2024 report, the average 401(k) balance is around $127,000. Here’s a more filtered breakdown of the average 401(k) balance by age range in 2022.

- Age 20-29: $14,600

- Age 30-39: $51,200

- Age 40-49: $120,200

- Age 50-59: $206,100

For historical perspective, according to Vanguard, another money management giant, the average participant 401(k) account balance at Vanguard was $112,572 at the end of 2022, down 20% from the close of 2021. The median 401(k) balance at Vanguard was $27,376 at the end of 2022, an annual drop of 23%.

In 2024, the average 401(k) balance by age is around $120,000 thanks to a rebound in the stock market. However, if you look at the average and median 401(k) balances by generation, they are all still pitifully low.

For more perspective, here is Fidelity’s 401(k) balances by generation as of 1Q 2023.

The Average 401(k) Balance By Age

Let’s focus on what people should have in their 401(k) by age. The entire goal is to accumulate enough money in your 401(k) and other retirement accounts to eventually live financially free.

As an educated reader who is logical and believes saving for retirement is a must, I’ve proposed a 401(k) savings by age recommendation table that shows how much each person should have s(a)ved in their 401k at age 25, 30, 35, 40, 45, 50, 55, 60, and 65. The amounts are much greater than the average 401k savings by age in America.

We stop at 65 because you are allowed to start withdrawing penalty free from your 401(k) at age 59 1/2. Meanwhile, I pray to goodness you don’t have to work much past 65. By age 65, you will have had 40+ years to save and investment already!

401k Savings By Age: How Much You Should Have

To determine how much you should have saved in your 401k by age, I’ve come with some assumptions that have encapsulated in a chart below. The goal is to accumulate as much in your 401(k) as possible to that by the time you can withdraw without penalty after age 59.5, you can live a comfortable retirement life.

The assumptions for the below chart are as follows:

- Low End column accounts for lower maximum contribution amounts available to savers above 45.

- Mid End column accounts for lower maximum contribution amounts available to savers below 45.

- High End column accounts for savers who are under the age of 25. After the first year, one maximizes their contribution every year to their 401k plan without failure.

- Average starting working age is 22. But you can follow the number of years working as a different guideline if you graduate later or earlier.

- $18,000 is used as the conservative base case maximum contribution amount for one’s entire working life.

- No after-tax income contribution, although more power to you if you have the disposable income to do so.

- The rate of return assumptions are between 0% – 10%.

- Company match assumption is between 0% – 100% of employee contribution. $61,000 is the total 401k contribution for 2022. But in 2025, the total 401(k) contribution between employee ($23,500) and employer ($46,500) is $70,000. Hence, find yourself a good employer! Employer profit sharing can be a huge benefit for your retirement.

- The Low, Mid, and High columns should successfully encapsulate about 80% of all 401(k) contributors who max out their contributions each year. There will be those with less, and those which much greater balances thanks to higher returns.

- You are logical and not a knucklehead. Just by searching this topic, you are taking ownership of your retirement and are thinking ahead with an action plan.

Financial Samurai 401(k) Savings By Age Guide

Here is my 401(k) savings targets by age.

From the results, we can see that even after 38 years of consistent saving, you’ll only have around $1,000,000 to $5,000,000 in your 401k in a realistic cycle of bull and bear markets. In other words, I believe everybody should become 401(k) millionaires by 60.

If you’re just starting your 401(k) savings journey, you could get lucky and achieve the high end column with consistent 8%+ annual growth and company profit sharing after 38 years. After all, the maximum 401(k) contributions will be much higher over the next 38 years than the previous 38 years.

But it’s most likely that most people reading this article should follow the middle-to-low end columns as a 401(k) savings guide. The median age in America is roughly 36. Meanwhile, the median age of a Financial Samurai reader is closer to 38.

Investing Matters Because Inflation Matters

Let’s say you live for 25 years after retiring at 60. You only get to live on $40,000 – $100,000 a year on the low-to-mid end. Sounds feasible in today’s dollars, but not so much in future dollars due to inflation.

If goodness forbid you live for 35 years after retiring at 60, then you can only live off of $28,571 – $71,000. If we use a 2% inflation rate to calculate what $1,000,000 – $5,000,000 is worth today, its only worth about $550,000 – $2,355,000.

We know that due to inflation, a dollar today will not go as far as a dollar 30+ years from now. Private university tuition will probably cost over $100,000 a year in 20 years. That is ridiculous since education is now free thanks to the internet.

Then there is the incredible growth of healthcare costs that is the most worrisome for retirees. For example, I’ve been paying $23,000+ a year in healthcare premiums for a platinum plan for my family of three. This is despite us all in good health.

Does that sound affordable for the average American household who makes $76,000 a year? Absolutely not, which is why employees should not underestimate the value of their overall work benefits.

In fact, inflation is the reason why it takes $3 million to be a real millionaire today. Make sure you own assets like stocks, real estate, and more to let inflation work for you!

Inflation Chart Of Consumer Goods And Services

Below is a great inflation chart by consumer goods and services. Medical, college tuition, food, and housing are categories that have inflated the most. This chart is a great visualization of why you must save aggressively in your 401(k) for retirement and boost your taxable investment portfolio.

To help grow your net worth, I recommend diligently tracking your net worth with Empower. Technology has come a long way since tracking our money by hand or with an Excel spreadsheet. Remember, what is measured can be optimized.

Depend On Nobody But Yourself For Retirement

Contribute the maximum pre-tax income you can to your 401(k) for as long as you work. This is the absolute MINIMUM you can do to by on the right 401k savings by age path.

Below is a chart that shows what you could have in your 401(k) if you max it out each year starting in 2023. The right hand column shows what you would have in your 401(k) with 8% compound annual returns.

In other words, everybody who consistently maxes out their 401(k) each year will likely be a 401(k) millionaire by the time they turn 60.

After you contribute a maximum to your 401k every year, try and contribute at least 20% of your after-tax income after 401k contribution to your savings or retirement portfolio accounts.

This way, you will have potentially DOUBLE the amount in total retirement saving if your household income is $100,000 or more. If your household income is closer to $50,000, you should still see a nice 30% boost to your retirement savings if you consistently save 20% of your after tax income. Here is the recommended order to contribute to your retirement accounts.

Do Not Count On Social Security Or Government Funds For Retirement

Treat your 401k just like Social Security and write it off completely from your mind. Do not expect either accounts to be there for you when you retire. It’s just like how you should never expect the government to ever help you when you’re in need.

Just imagine 30 years from now, the government deciding to raise penalty free 401k withdrawal to age 75 from 59.5? Unfortunately, you need the money at age 60. Because you withdraw, the government imposes a 30% penalty on top of the taxes you have to pay. Don’t think it can’t happen. Expect it to happen!

Taxable Investment Portfolio Is Key

The only thing you can count on is after-tax money you’ve invested or saved. This is why after maxing out your 401k, it’s good to open up an after-tax brokerage account. Consistently contribute a percentage of your paycheck each mont into your taxable investment portfolio. I recommend at least 20%.

Your goal should be to then build as many passive income streams as possible. The more passive income streams and active income streams you have, the more financially free you will be.

Challenge yourself to raise your after-tax and 401k contribution savings percent to possibly 50%. It won’t be easy. But if you practice raising your savings rate by 1% a month until it hurts, you’ll find it easier than you think.

A straightforward way to maximum savings is to make your 401(k) maximum contribution automatic. Save every other paycheck for the rest of your working life.

Max out your 401k and save over 50% of your after-tax income for at least 10 years in a row. If you do, you will be financially free to do whatever you want!

Recommendation To Growing A Larger 401(k)

Now that you know what the appropriate 401(k) savings by age is, it’s time to manage your finances like a hawk. To do so, sign up for Empower, the web’s #1 free wealth management tool. Empower will enable you to get a better handle on your finances.

In addition to better money oversight, run your investments through their award-winning Investment Checkup tool. I will show you exactly how much you are paying in fees. I was paying $1,700 a year in fees I had no idea I was paying.

After you link all your accounts, use their Retirement Planning calculator. It pulls your real data to give you as pure an estimation of your financial future as possible using Monte Carlo simulation algorithms. Definitely run your numbers to see how you’re doing.

To track my 401(k) savings by age guide you must max out your 401k each year. With investment returns coupled with company matching, you’ll be amazed how much you will accumulate over the years.

Free Financial Analysis Offer From Empower

If you have over $100,000 in investable assets—whether in savings, taxable accounts, 401(k)s, or IRAs—you can get a free financial check-up from an Empower financial professional by signing up here. It’s a no-obligation way to have a seasoned expert, who builds and analyzes portfolios for a living, review your finances.

A fresh set of eyes could uncover hidden fees, inefficient allocations, or opportunities to optimize—giving you greater clarity and confidence in your financial plan.

I’ve been using Empower’s free financial tools and speaking with their financial professionals since 2012. From 2013 to 2015, I also consulted part-time at their offices when they were still called Personal Capital. As both a longtime user and affiliate partner, I’m genuinely pleased with the value they’ve consistently delivered over the years.

The statement is provided to you by Financial Samurai (“Promoter”) who has entered into a written referral agreement with Empower Advisory Group, LLC (“EAG”). Click here to learn more.

Build More Wealth Through Real Estate

In addition to investing in stocks and bonds through your 401(k), I recommend diversifying into real estate. Real estate is a core asset class that has proven to build long-term wealth.

It’s important to own a tangible asset that provides utility and a steady stream of income. Unlike stock values, real estate values tend to be much less volatile. Use real estate to generate passive income and distributions before age 59.5 which is when you can withdraw from a 401k penalty-free.

My Favorite Private Real Estate Platform

Take a look at Fundrise, my favorite private real estate platform. Fundrise runs about $3 billion in assets for almost 400,000 investors today. Its funds focus on the Sunbelt region, where valuations tend to be lower and yields tend to be higher.

I’ve personally invested over $1,000,000 in real estate crowdfunding across 18 projects. My goal is to take advantage of lower valuations in the heartland of America. My real estate investments account for roughly 50% of my current passive income of ~$320,000.

Fundrise is a long-time sponsor of Financial Samurai and Financial Samurai is a six-figure investor in Fundrise.

Order My New Book: Millionaire Milestones

Finally, if you’re ready to build more wealth than 90% of the population, grab a copy of my new USA TODAY national bestseller, Millionaire Milestones: Simple Steps to Seven Figures. With over 30 years of experience working in, studying, and writing about finance, I’ve distilled everything I know into this practical guide to help you achieve financial success.

Here’s the truth: life gets better when you have money. Financial security gives you the freedom to live on your terms and the peace of mind that your children and loved ones are taken care of.

Millionaire Milestones is your roadmap to building the wealth you need to live the life you’ve always dreamed of. Order your copy today and take the first step toward the financial future you deserve!

Follow my 401k savings by age guide. But in the meantime, also build a passive income portfolio so you can live a better life today. Given you cannot withdraw from your 401k without penalty until 59.5, it is your passive investment portfolio that matters even more.

How Much Should I Have Saved In My 401k By Age is a Financial Samurai original post. Everything I write is based off first hand experience because money is too important to be left up to pontification. Join 65,000+ others and sign up for my free weekly newsletter as well. In 2009 I launched Financial Samurai and started the modern-day FIRE movement. Then in 2012, I retired at age 34 with about $3 million.