Let’s say you’ve currently got a good amount of cash to invest. $250,000 in this case. With the potential for a global financial recession due to still-high interest rates and continued trade wars, investing is now getting trickier. At the same time, inflation has peaked and now the Fed will likely be cutting rates by end of 2025.

As a value investor, I think there’s great opportunity in buying commercial real estate. Valuations are attractive, with prices almost declining by as much as they did during the 2008 global financial crisis. Yet, the economy and corporate and household balance sheets are much stronger today. If rates continue to fall, residential commercial real estate and office will benefit.

Another compelling opportunity is investing in private artificial intelligence companies. AI is clearly set to disrupt the labor market and significantly boost productivity. Since private companies are staying private longer, it makes sense to allocate more capital to them and capture more of the upside. I’m doing this through Fundrise Venture, an open-ended fund with just a $10 minimum and exposure to leading private companies like OpenAI, Anduril, and Anthropic.

Despite all the volatility in recent years, the main lesson from this post is to keep on investing, no matter what.

Your capital deployment strategy may be different than mine, but so long as you keep on investing, you will likely benefit in the long run. Make your money work for you given inflation hurts your purchasing power.

Background Info To Understand Our Investment Process

I’m 48 and my wife is 44. Our kids are 8 and 5. We consider ourselves moderate-risk investors since we haven’t had regular day job income since 2012 for me and 2015 for my wife.

We fear having to go back to work full-time, not because of work itself but because we fear losing our freedom to spend time with our young children. Once they turn 18, 80%+ of the time we will ever spend with them is gone. As a result, we are unwilling to take too much investment risk at this stage.

Although we don’t have day jobs, we do generate passive investment income to cover most of our living expenses. Our passive income used to cover about 120% of our living expenses until we bought a forever home in 2023.

We also generate online income, which we reinvest 60%+ of it to help generate more passive income. Therefore, our cash pile will continue to build if we don’t spend or invest all the money.

Our children’s educational expenses are on track after we superfunded two 529 plans when they were born. We also have life insurance and estate planning set up.

If you have children and debt, get a term life insurance policy to protect your little ones. Both my wife and I got matching 20-year term policies during the pandemic through Policygenius. After we did, we felt a huge sense of relief.

How I’d Invest $250,000 Cash Today

This is not investment advice for you as everybody’s financial goals, risk tolerance, and situation are different. Please always do your own due diligence before making any investment. Your investment decisions are yours alone. Here’s how I’d invest $250,000 of cash today.

1) Treasury Bonds (30% Of Cash Holding)

Only about 4% of our net worth is in bonds, mostly individual muni bonds and Treasury bonds we plan to hold until maturity. Our target annual net worth growth rate is 3X the 10-year bond yield. We use the 10-year bond yield as the risk-free rate of return to help decide where else to invest.

The 10-year yield is currently at ~4.3%, UP about 1% AFTER the Fed Chair Jerome Powell CUT by 50 basis points on September 18, 2024 and another 25 basis points in November and December. One or two more rate cuts are likely by the end of 2025.

Trump’s victory has caused concern for policies that may reignite inflation. But I suspect there to be a compromise by August for the largest trading partners given nobody benefits from higher prices and recessions.

After a huge gains in 2023 on 2024, I think there’s a 60% chance the 10-year Treasury bond outperforms the S&P 500 in 2025. The stock market is vulnerable given its high valuations and erratic government policies.

At a 4.3% interest rate for a 10-year Treasury bond, earning risk-free passive income feels wonderful. However, if you’re still early in your financial independence journey, settling for comfort instead of taking calculated investment and career risks may cost you in the long run.

Although locking in a 4.3% Treasury bond return won’t make us rich, it may provide us peace of mind in an upcoming recession or stagflation. You just have to also be OK with not making more money if other risk assets continue to do well.

Below is a recent bond yield table for all the various types of bonds you can buy, by duration. The Treasury bond yield curve was inverted (short end 3-month rate is higher than the 10-year rate) for many months, but now it’s back to normal. The Fed is likely to cut rates two more times for the rest of 2025.

Now that we’ve deployed 30% of our cash in Treasury bonds, the remaining 69.9% of our cash will be invested in risk assets.

2) Stocks (20% Of Cash Holdings)

Roughly 28% of our net worth is in stocks after paying cash for a new house in 2023. The range has fluctuated between 25% – 35% since I left work in 2012. Hence, I’m building back my public equity exposure to around 30% of net worth.

Since I started working in equities in 1999, I’ve actually tried to regularly diversify away from stocks and into hard assets. My career and pay were already leveraged to the stock market. And I saw so many great fortunes made and lost during my time in the industry.

If you invest in growth stocks in particular, you must take some profits from time to time given they generate no income. Selling is the only way to capitalize on your gains, especially if you have excess investment gains. Otherwise, there’s no point as their value could easily correct.

We almost always front-loaded our stock purchases for the year through our kids’ Roth IRAs, custodial accounts, SEP IRAs, and 529 plans. This year is no different. So a correction in the stock market would be beneficial for our new cash flow.

Most of the time it works out, some of the time it doesn’t, like in 2022. That’s market timing for you. But we got to front-load our tax-advantaged investments again in 2023 and 2024, which has worked out well. Keep on investing consistently! The amounts add up over time.

In addition to maxing out all our tax-advantaged accounts, we’ve been regular contributors to our taxable online brokerage accounts. After all, in order to retire early, you need a much larger taxable investment portfolio to live off its income before age 59.5. One of the biggest mistakes I’ve seen retirement planners commit is only focusing on building their tax-advantaged accounts.

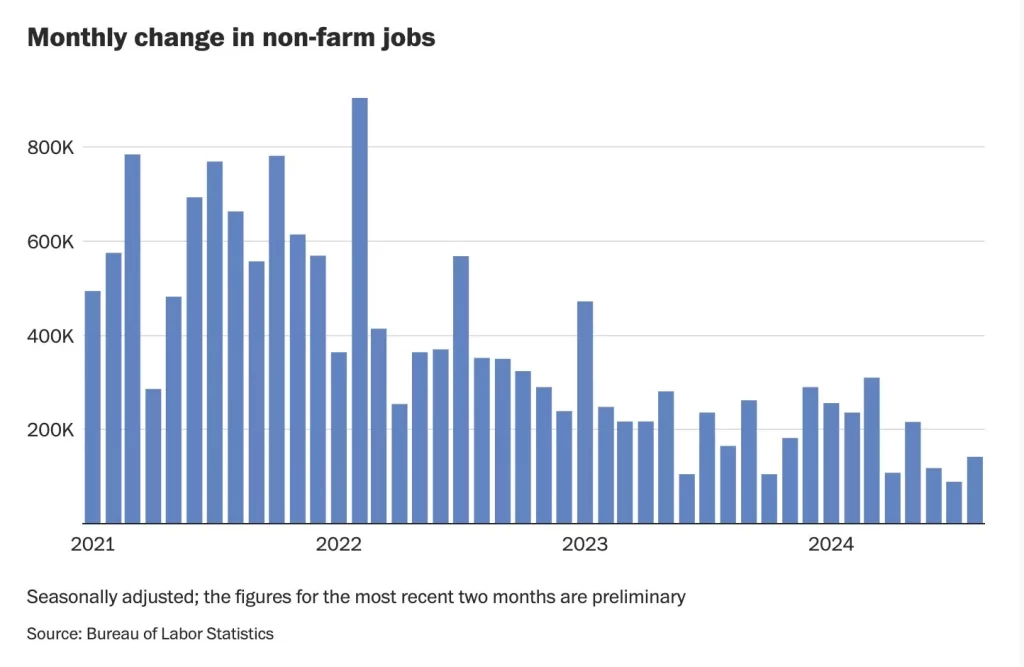

Stocks Are Expensive And Vulnerable To A Correction

The median 2025 S&P 500 forecast was about 6,500 at the beginning of the year, now it’s about 6,200 after Trump started the trade wars. Stocks are trading back at ~22.5X forward earnings versus 17.5 its historical average.

If the S&P 500 reverts to its historical average valuation, it could drop to ~5,000 (which it did, to 4,850), and keep going down as we trade at a discount to historical valuations due to the trade wars. At the same time, 2025 S&P 500 earnings are expected to increase by ~10%.

Given expensive valuations, I’m just buying in $1,000 – $5,000 tranches of S&P 500 only after every 0.5% – 1% decline. We briefly entered a bear market in April and I was more aggressively dollar-cost averaging. The market simply doesn’t look attractive anymore, especially with risks of a recession or stagflation on the horizon.

The key is to always have some cash to be able to buy the dip. No cash, no benefit. Just take your time as the market could easily dip again.

Here is a post that provides a framework for your stock allocation by bond yield. The higher risk-free bond yields go, the lower your stock allocation is recommended to be and vice versa. With Treasury bond yields declining, the opportunity cost of not holding them also goes down.

If I was in my 20s and 30s, I would allocate 50% of my cash to buying stocks instead of just 20%. The remaining 20% would go to online real estate as the sector rebounds, 20% to venture capital funds, and only 10% would go to Treasuries and education. Remember, every investment is based off an individual’s personal financial situation and goals.

3) Venture Capital (25% Of Cash Holding)

As a hedge against not investing aggressively in public stocks, I am investing more in private growth companies. I enjoy investing in private funds because they are long-term investments with no day-to-day price updates. As a result, these investments cause little stress and are easy to forget about. Private investing forces you to invest for the long run as you meet capital calls over the years of deployment.

I’ve already made capital commitments to a couple closed-end venture capital funds and a venture debt fund. As a result, I will just keep contributing to these funds whenever there are capital calls.

Venture capital started making a comeback in 2024 given private company valuations took a hit since 2022. Capital often rotates toward the biggest underperforming asset classes. The momentum continues in 2025.

Investing In Artificial Intelligence

I’m excited about investing in artificial intelligence, one of the biggest investment opportunities over the next decade. My closed-end VC funds are actively making AI investments. But these funds are invite only with $100,000+ minimums.

Thankfully, Fundrise introduced their venture capital product at the end of 2022, which was at the bottom of the private market downturn. Fundrise was able to invest in private growth companies like OpenAI and Anthropic at more reasonable valuations. Once these companies do raise a new round of funding or go IPO, given their continued growth, there could be upside potential in valuation.

I ended up investing $153,000 in Fundrise Venture in 1H 2024, and another $100,000 in mid-2025. My main goal is to build a $500,000 position and ride the wave for the next 10 years. The investment minimum is only $10 and the product is open to all.

Private companies are staying private for longer, which is why I’m logically allocating more to private companies to participate in their potential upside.

20 years from now, I don’t want my kids asking me why I didn’t invest in AI or work in AI given I had a chance to near the beginning. By investing in funds that invest in AI, at least I’ll be able to benefit if I can’t get a job in AI. The successful IPO of ServiceTitan, a Fundrise Venture holding is great evidence the demand for private growth companies should continue to grow.

Here’s a discussion I had with Ben Miller, CEO of Fundrise, about artificial intelligence and investing in growth companies. Roughly 75% of the venture capital product is invested in AI companies. I’ve currently invested $250,000+ in Fundrise’s venture product so far.

4) Real Estate (24.9% Of Cash Holding)

I’m bullish on real estate in 2025 as the sector plays catch-up to stocks. With mortgage rates slowly coming down and pent-up demand building, prices should move higher. In addition, stock investors are much wealthier, leading to more stock rotating into real estate. As a result, I’m actively investing in real estate funds today.

Real estate is my favorite asset class to build wealth for the average person. It provides shelter, generates income, and is less volatile. Unlike with some stocks, real estate values just don’t decline by massive amounts overnight due to some small earnings miss. Real estate accounts for about 50% of our net worth.

In areas like San Francisco, where big tech and AI is booming, home prices could rise much greater than the national average. In 2024, there was a double digit percentage rebound in home prices due to intense bidding wars in the spring.

2025 started off strong because the vast majority of investors are wealthier one year later with the S&P 500 up 23% in 2024. A lot of those gains will go into buying residential real estate and residential commercial real estate.

However, as higher-for-longer interest rates remain, the momentum in real estate is now fading once more starting in the summer. The Fed needs to cut and Treasury bond yields need to decline below 4% to make housing affordable again.

Strategically Investing In Private Real Estate

I will continue to dollar-cost average into private real estate funds like Fundrise that invest in single-family homes and industrial properties in the Sunbelt. Valuations tend to be lower and yields tend to be higher in non-coastal states. The invest minimum is only $10 so contributing is easy. I’ve currently invested $300,000 with Fundrise so far.

Depending on where you are in the country, prices and rents are down 3%-18% from the highs, hence the opportunity to buy now at lower prices. Sunbelt real estate should be a long-term beneficiary of demographic trends, technology, and work from home.

With the stock market up so much, investors are going to logically convert some of their funny money gains into real assets. In a stagflation environment, real estate will likely significantly outperform stocks. For commercial real estate, we are past the bottom with attractive prices currently. Big firms such as Blackstone are actively investing in commercial real estate today.

In my opinion, residential commercial real estate is the most attractive real estate to own. Apartment values are down almost as much as they were during the 2008 Global Financial Crisis, yet the economy is much stronger and corporate and household balances are much healthier. Hence, I see great opportunity to buy the commercial real estate dip at the current time.

5) Debt Pay Down (0% Of Cash Holding)

With the Treasury bond yields still higher than the average 30-year fixed mortgage rate, paying down mortgage debt is a suboptimal move.

If you have debt, consider following my FS DAIR investing and debt pay down framework. It gives you a logical framework recommending how much of your cash flow you should use to pay down debt or invest.

If you do decide to aggressively pay down debt, just make sure you don’t compromise your liquidity too much in any market. Always have at least six months of living expenses in cash. You never know when a downturn will come.

6) Financial Education (0.1% of Cash Holding)

Education is one of the best long-term investments. The paradox of education is it is extremely important to help you build wealth, yet it is also inexpensive or free today. Rich people are reading all the time. Poor people are watching TV all the time!

For under $20 after tax you can order my instant USA TODAY national bestseller, Millionaire Milestones: Simple Steps To Seven Figures, and immediately gain a competitive advantage to building wealth. Most people don’t read or get deep into personal finances. Pick up a copy on Amazon today to build more wealth than 94% of the population.

I am also the WSJ bestseller of Buy This Not That: How To Spend Your Way To Wealth And Freedom. The book helps you think in probabilities and make better decisions with some of life’s biggest dilemmas.

If you want to learn how to negotiate a severance and be free from a job you dislike, then read How To Engineer Your Layoff. A severance package was my #1 catalyst to leave finance behind in 2012. I haven’t returned to work since thanks to receiving a six-figure severance package. Freedom is priceless. Use the code “saveten” at checkout to save $10.

You could also join 60,000+ others and subscribe to my free weekly newsletter and my free blog posts to stay on top of timely financial topics. I’ve been publishing three posts a week since July 2009.

You can also subscribe to my podcast on Apple or Spotify. The more you immerse yourself in money topics, the more you will learn and take appropriate action to help boost your wealth.

Finally, can also go to YouTube, Khan Academy, or MOOC and watch hundreds of hours of free educational videos. Or you can pay for online courses to get even deeper into a subject.

Ignorance is no longer an excuse given how accessible education is today. Over time, the combination of experience and education will dramatically improve your confidence, wealth, and peace of mind.

Keep On Investing For The Long Term

The key to becoming a successful investor is to consistently invest for the long term. While you will encounter corrections and bear markets along the way, over the long term, risk assets such as stocks and real estate have historically yielded positive real returns.

However, it’s essential not to lose sight of the purpose behind your investments. If your gains are sufficient to cover your intended goals, it’s acceptable to consider selling. The objective is not to accumulate money endlessly but rather to utilize your funds to enhance your quality of life.

Personally, I’m investing to:

- Give my family the best life possible

- Pay for expensive college tuition starting in 2035 and 2038

- Maintain the freedom I’ve had from full-time work since 2012

- Take care of my parents if needed

- Have a comfortable retirement lifestyle

- Travel internationally now that my youngest is 5 and can form strong memories

- Give back to my favorite non-profit organizations such as the Pomeroy Center for those with special needs

- Fund my children’s custodial investment accounts so they have more financial security as adults

- Continue writing and recording on Financial Samurai freely without a paywall

Diversify Into Real Estate And Venture Capital

To invest in real estate more strategically, check out Fundrise. Fundrise manages almost $3 billion across multiple funds for over 350,000 investors that primary invest in the Sunbelt region where valuations are lower and yields are higher. I expect the real estate market to rebound as mortgage rates come down.

To invest in private growth companies, check out the venture capital at Fundrise. The product invests in private companies in the artificial intelligence, prop tech, fin tech, and datacenter space. Private companies are staying private for longer, meaning more gains are accruing to the private investor.